Mauricio Moscovici

Partner

03/10/25

On October 1st, the Chamber of Deputies unanimously approved Bill No. 1,087/2025 (“PL No. 1,087/2025”), which increases the income tax exemption range (up to R$ 5,000.00 per month) and establishes a minimum income tax percentage (referred to as high income taxation).

General rule: as of January 2026, withholding tax of 10% on dividends above R$ 50,000.00 paid, credited, employed, or delivered by the same legal entity to the same individual in Brazil in a single month.

The amount withheld at source is an advance on the calculation of the annual high income tax.

General rule: as of 2026, minimum IRPF (“IRPFM”) taxation on individuals with incomes above R$ 600,000.00 in the calendar year (to be paid in the following fiscal year).

IRPFM tax rate:

Income subject to IRPFM: all, including exempt income, subject to zero or reduced rates, except in cases expressly provided for by law. Exceptions include: exempt portion of rural activity, capital gains (except gains on stock exchange/over-the-counter transactions), advance donations of legitimate inheritance, savings income, LCI, LCA, CRI, CRA, CDA/WA, CDCA and (under certain conditions) FIAGRO/FII.

Operation: the mechanics of the PL involve applying the tax rate to income to verify that the taxpayer has paid at least 10% (or a proportional rate, if their income is greater than R$ 600,000.00 and less than R$ 1,200,000.00) of tax on their total income. From this amount, income tax amounts paid throughout the period, such as IRRF, monthly payments, and monthly taxation of dividends above R$ 50,000.00, may be deducted. If there is any tax remaining to be paid, the taxpayer must make an additional payment when filing their annual income tax return.

Reduction: there is a mechanism that reduces the amount of IRPFM if the sum of the effective rates for legal entities and individuals exceeds the nominal IRPJ and CSLL rates for legal entities (normally 34%). For companies that do not calculate IRPJ and CSLL based on actual profits, there will be a simplified calculation of the effective rate based on revenue and certain deductions (payroll, purchase price of goods/raw materials, rent for real estate necessary for the operation of the legal entity, etc.).

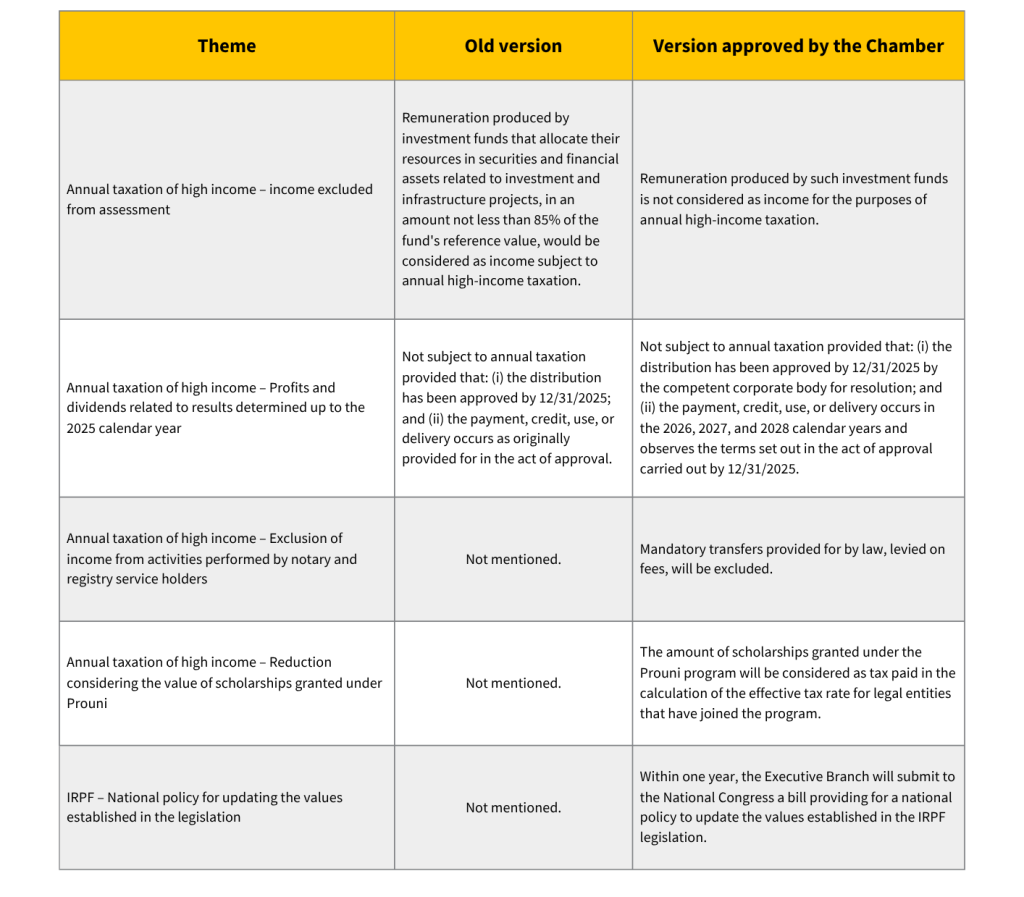

Profits and dividends related to results calculated up to 2025 (“stock”): not subject to IRPFM, provided that: (i) the distribution has been approved by December 31, 2025, by the corporate body competent for deliberation; and (ii) the payment, credit, use, or delivery occurs in the calendar years 2026, 2027, and 2028 and complies with the terms set forth in the approval act.

IRRF tax at a fixed rate of 10%, whether the beneficiary is an individual or a legal entity.

Reduction: calculation similar to that for residents in Brazil, but with a different mechanism. Instead of reducing IRPFM, possibility of appropriating credit that can be claimed within 360 days “counted from each fiscal year.” Details will be provided in regulations.

Bill No. 1,087/2025 will be sent to the Federal Senate for consideration and voting. If there are any amendments, it will return to the Chamber of Deputies for consideration.

The Tax Team at FLH Advogados is available to answer any questions on this topic.